Net Present Value Excel Template

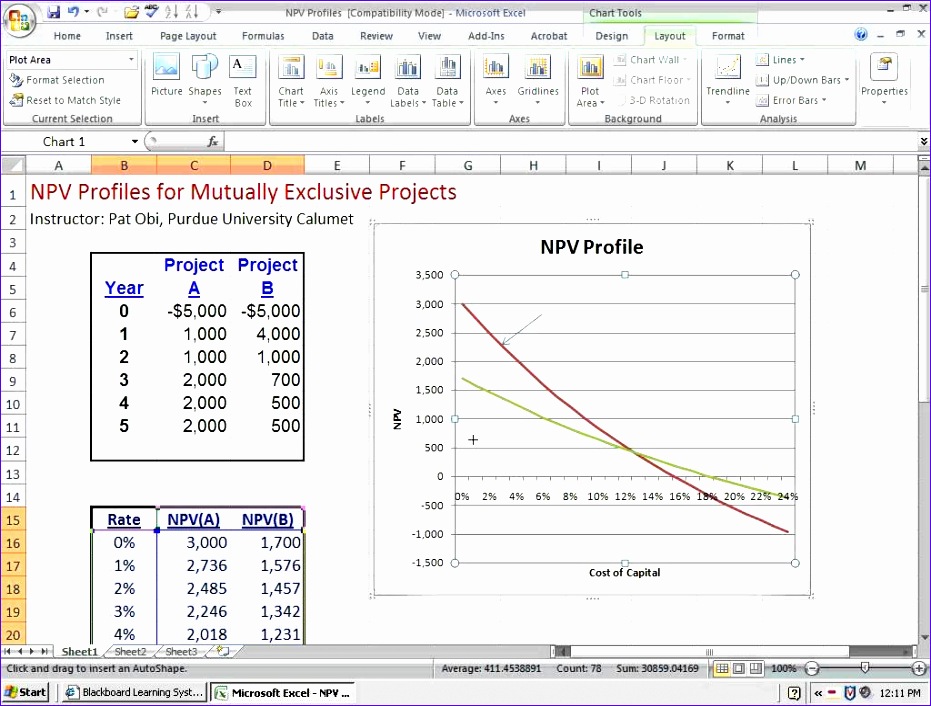

Net Present Value Excel Template - Here is a screenshot of the net present value template: Web the npv function is categorized under excel financial functions. The rate of discount over the length of one period. Npv (rate,value1, [value2],.) the npv function syntax has the following arguments: Enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more.

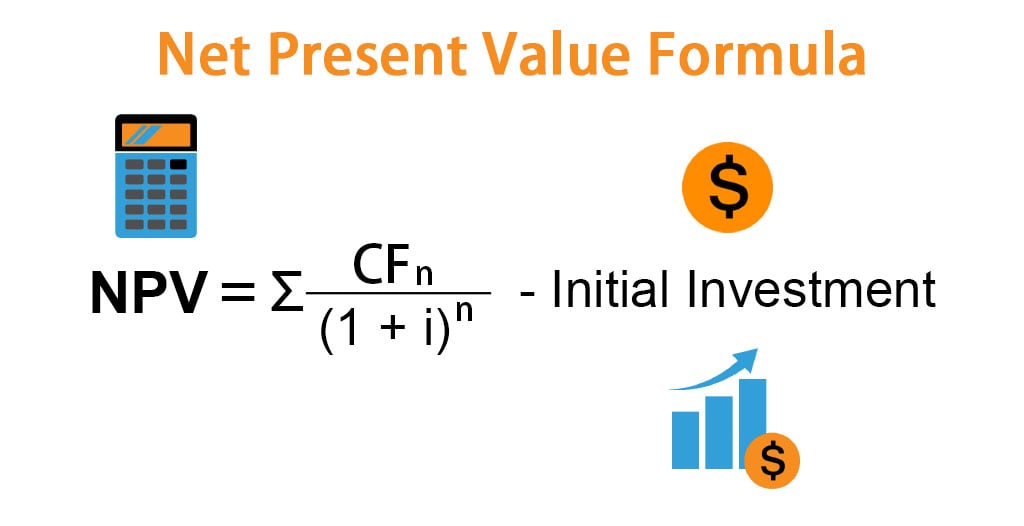

Set a discount rate in a cell. Web the npv function is categorized under excel financial functions. It will calculate the net present value (npv) for periodic cash flows. Calculate the value of the unlevered firm or project (vu), i.e. The formula for net present value is: Pv analysis is used to value a range of assets from stocks and bonds to real estate and annuities. Ad free shipping on qualified orders.

6 Net Present Value Excel Template Excel Templates

Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Web formula for the net present value is given below: =pv (b4/12,b5*12,b3,b6,b7) notice that the result has a negative value: Get powerful, streamlined insights into your company’s finances. The.

Net Present Value Calculator Excel Template SampleTemplatess

Z2 = cash flow in time 2. Download spreadsheets shared by others and customize them online The formula for net present value is: Web npv is the value that represents the current value of all the future cash flows without the initial investment. Cbca®commercial banking & credit analyst. Get support for this template. The bigger.

8 Npv Calculator Excel Template Excel Templates

Get support for this template. The purchase price / initial investment) why is net present value (npv) analysis used? Get powerful, streamlined insights into your company’s finances. The formula for net present value is: Let me explain with an example. It is used to determine the profitability you derive from a project. Calculate the net.

10 Excel Net Present Value Template Excel Templates

An npv of zero or higher forecasts profitability for a project or investment;. Ad free shipping on qualified orders. Enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Enter your name and email in the form below and download the free template now! Free, easy returns on millions of items..

Professional Net Present Value Calculator Excel Template Excel TMP

Get powerful, streamlined insights into your company’s finances. Before i get into calculating the npv value next cell, let me quickly explain what it really means. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Calculate the value of the unlevered firm.

Net Present Value Calculator »

An npv of zero or higher forecasts profitability for a project or investment;. Here is a screenshot of the net present value template: Web download this template for free. The purchase price / initial investment) why is net present value (npv) analysis used? Set a discount rate in a cell. Get support for this template..

Net Present Value Formula Examples With Excel Template

The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. An npv of zero or higher forecasts profitability for a project or investment;. Cfn = cash flow in the nth period. Get powerful, streamlined insights into your company’s finances. For.

10 Excel Net Present Value Template Excel Templates

In financial, there are some standard value measurement that usually used to measure whether a new business or a new project is profitable or not. Get started today and make informed decisions about your investments! Here is a screenshot of the net present value template: Establish a series of cash flows (must be in consecutive.

Net Present Value Calculator Excel Templates

Get started today and make informed decisions about your investments! Enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Pv analysis is used to value a range of assets from stocks and bonds to real estate and annuities. Ad free shipping on qualified orders. Ad free shipping on qualified orders..

Net Present Value Formula Examples With Excel Template

Get support for this template. Enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Use this free excel template to easily calculate the npv of any investment and determine if it is worth pursuing. Set a discount rate in a cell. In simple terms, npv can be defined as the.

Net Present Value Excel Template Establish a series of cash flows (must be in consecutive cells). Let me explain with an example. Enter your name and email in the form below and download the free template now! Free spreadsheet templates & excel templates. It will calculate the net present value (npv) for periodic cash flows.

The Net Present Value (Npv) Represents The Discounted Values Of Future Cash Inflows And Outflows Related To A Specific Investment Or Project.

Calculate the net value of debt financing (pvf), which is the sum of various effects, including: It will calculate the net present value (npv) for periodic cash flows. =pv (b4/12,b5*12,b3,b6,b7) notice that the result has a negative value: Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows.

Click Cell B10 And Enter The Function:

What is the net present value formula? Z1 = cash flow in time 1. Although npv carries the idea of net, as in the present value of future cash flows. Irr is based on npv.

Z2 = Cash Flow In Time 2.

Get powerful, streamlined insights into your company’s finances. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. You can use excel to calculate npv instead of figuring it manually. Get started today and make informed decisions about your investments!

It Is Used To Determine The Profitability You Derive From A Project.

Ad free shipping on qualified orders. Establish a series of cash flows (must be in consecutive cells). Get support for this template. Npv (short for net present value), as the name suggests is the net value of all your future cashflows (which could be positive or negative)