Discounted Cash Flow Template

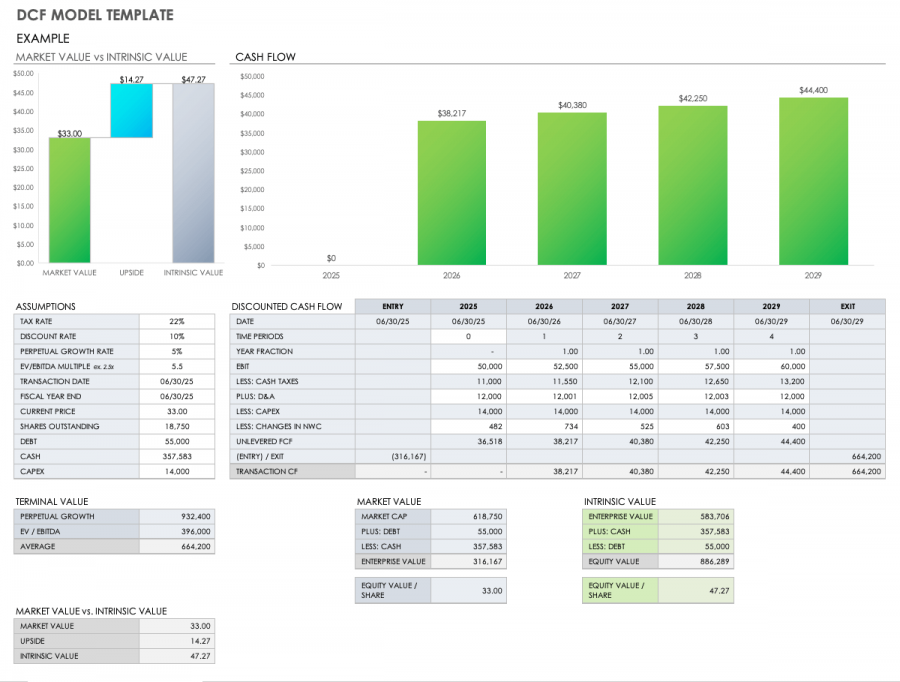

Discounted Cash Flow Template - Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. The purpose of the discounted free cash flow financial model template is to provide the user with a. Dcf analysis can be applied to value a. Below is a preview of the dcf model template: Web discounted cash flow (dcf) excel model template.

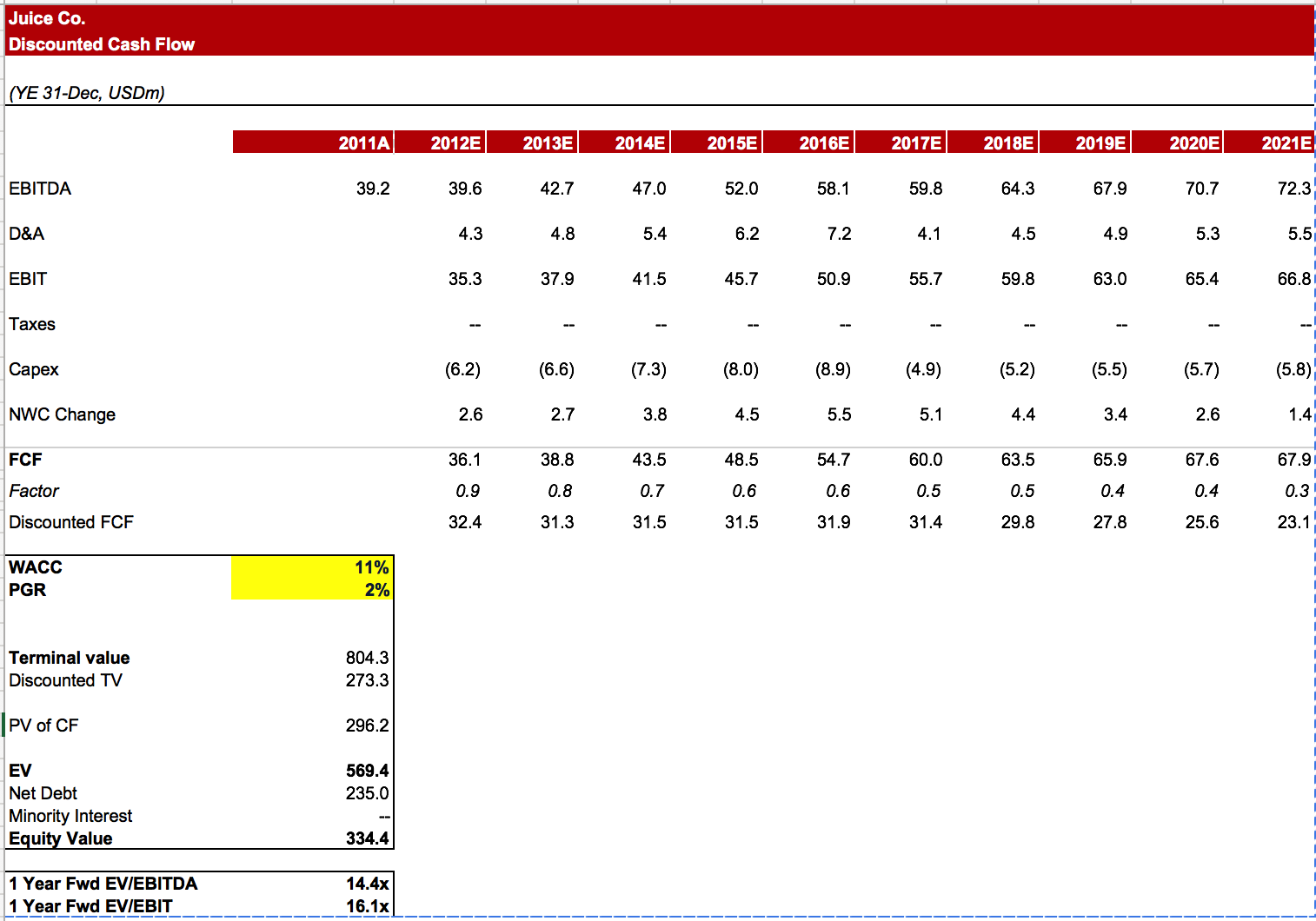

Enter your name and email in the form below and download the free template now! The purpose of the discounted free cash flow financial model template is to provide the user with a. Web on this page, you’ll find the following: Download wso's free discounted cash flow (dcf) model template below! Here is what the discount factor. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. + cfn / (1 + r)^n) + tv / (1+r)^n where:

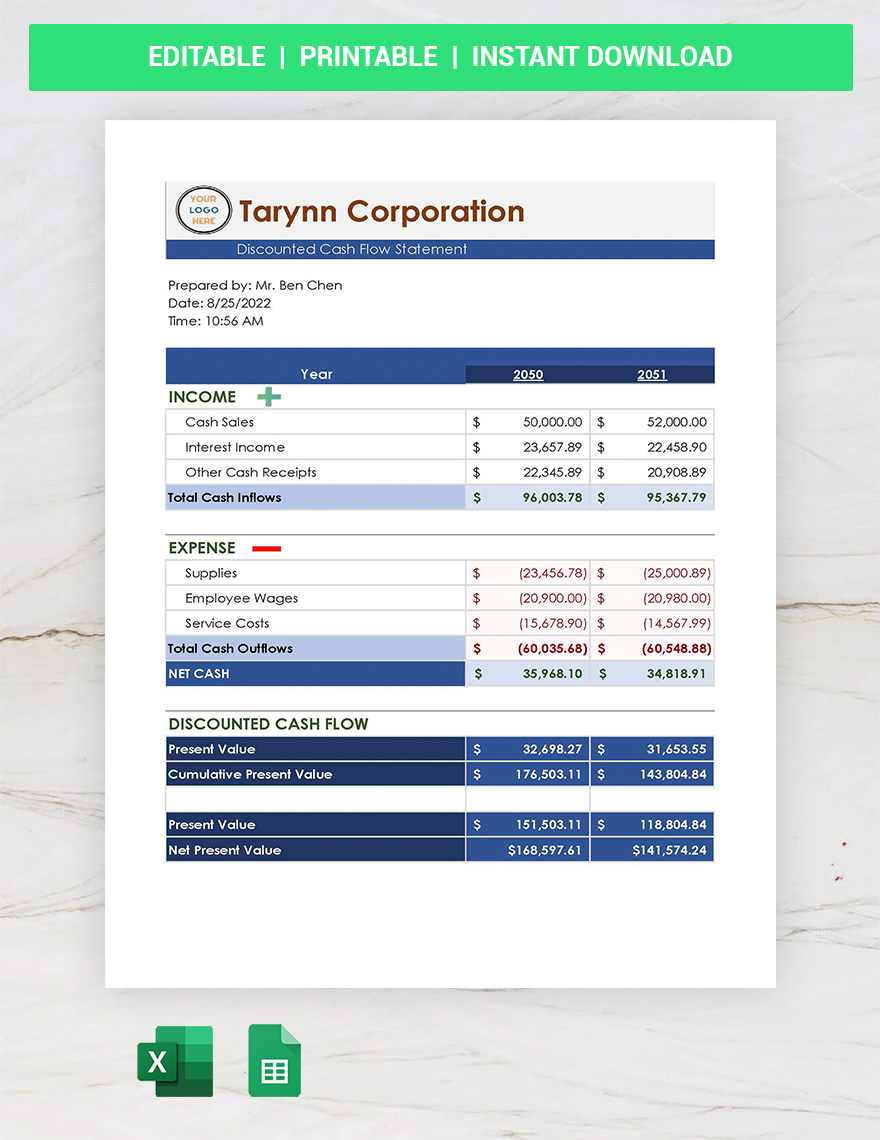

Discounted Cash Flow Template Google Docs, Google Sheets, Excel, Word

Here is what the discount factor. Enter your name and email in the form below and download the free template now! Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. The formula for dcf is: Web discounted cash flow (dcf) is an analysis method used to value investment by discounting.

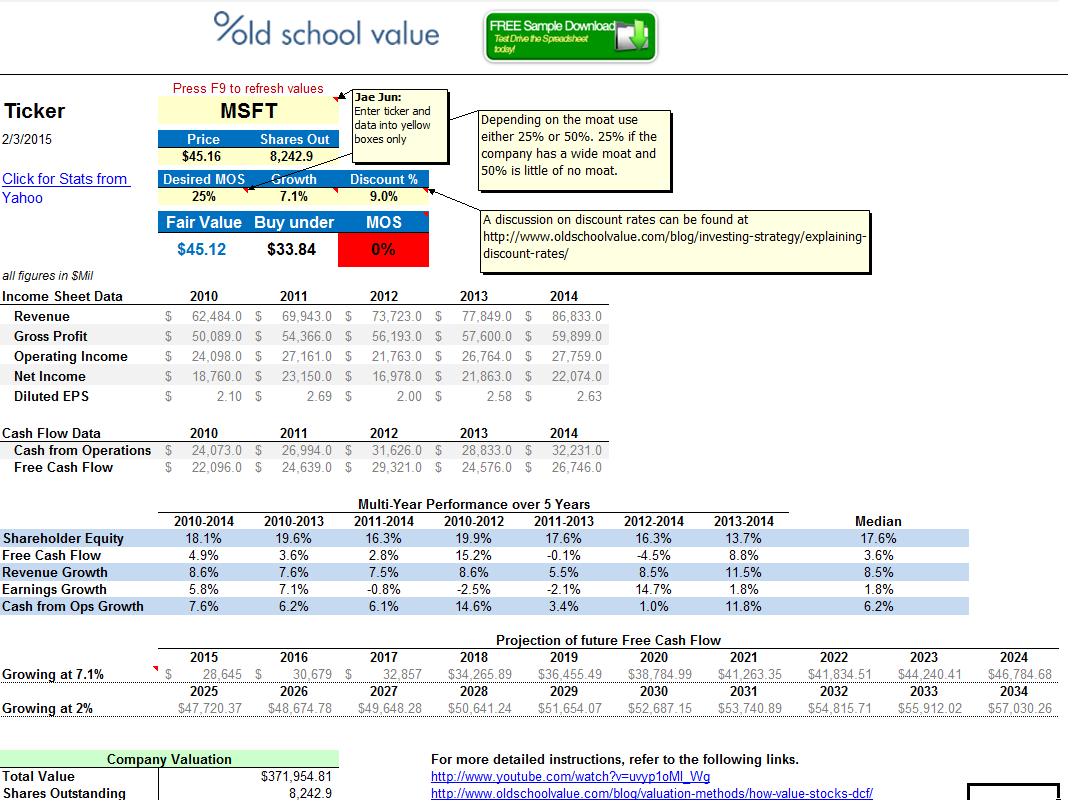

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Web the discounted cash flow (dcf) formula is equal to the sum of the in each period divided by one plus the discount rate () raised to the power of the period number. Web the executive summary also provides a quick overview of the whole dcf excel template. Get powerful, streamlined insights into your company’s.

Discounted Cash Flow (DCF) Model Macabacus

Below is a preview of the dcf model template: Web on this page, you’ll find the following: Web discounted cash flow template. Here is what the discount factor. The formula for dcf is: Web the executive summary also provides a quick overview of the whole dcf excel template. This template allows you to build your.

Discounted Cash Flow Spreadsheet

Enter your name and email in the form below and download the free template now! Tips for doing a discounted cash flow analysis; Web the dcf formula is: Having a discounted cash flow model ready is very useful for explaining a business’s. This discount factor template helps you calculate the amount of discounted cash flows.

Free Discounted Cash Flow Templates Smartsheet

Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Cf1 to cfn are the forecasted cash flows. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in year r=..

Free Discounted Cash Flow Templates Smartsheet

Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. The purpose of the discounted free cash flow financial model template is to provide the user with a. Tips for doing a discounted cash flow analysis; Get powerful, streamlined insights into your company’s finances. In.

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Enter your name and email in the form below and download the free template now! R is the discount rate. Web discounted cash flow template. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. The purpose of the discounted free cash flow financial.

Discounted Cash Flow (DCF) Model Macabacus

Cf1 to cfn are the forecasted cash flows. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Get powerful, streamlined insights into your company’s finances. + cfn / (1 + r)^n) + tv / (1+r)^n where: Below is a preview of.

7 Cash Flow Analysis Template Excel Excel Templates

This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web dcf stands for discounted cash flow, so a dcf model.

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

This template allows you to build your own discounted cash flow model with. Having a discounted cash flow model ready is very useful for explaining a business’s. Web the discounted cash flow (dcf) formula is equal to the sum of the in each period divided by one plus the discount rate () raised to the.

Discounted Cash Flow Template Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in year r=. The formula for dcf is: In the template below you can see the same projected cash flow for each. Cf1 to cfn are the forecasted cash flows. Download wso's free discounted cash flow (dcf) model template below!

+ Cfn / (1 + R)^N) + Tv / (1+R)^N Where:

Get powerful, streamlined insights into your company’s finances. Web on this page, you’ll find the following: Web the executive summary also provides a quick overview of the whole dcf excel template. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn where, cf = cash flow in year r=.

Web Discounted Cash Flow (Dcf) Excel Model Template.

In the template below you can see the same projected cash flow for each. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called. This template allows you to build your own discounted cash flow model with. This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors.

The Discounted Cash Flow Formula;

Dcf analysis can be applied to value a. R is the discount rate. The model is completely flexible, so that when you put in the. Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows.

Web Discounted Cash Flow (Dcf) Valuation Model Is A Way To Value A Company/Project Based On Its Future Cash Flows.

The purpose of the discounted free cash flow financial model template is to provide the user with a. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Here is what the discount factor. Cf1 to cfn are the forecasted cash flows.