Discounted Cash Flow Template Excel

Discounted Cash Flow Template Excel - Discounted cash flow analysis template; “year”, “cash flow”, “discount rate”, “present value factor”, and “discounted cash flow”. The only thing left here is to calculate the total of all these. Web to do that, i’ll use a formula that takes the cash flow value, multiples it by the discount rate (i’ll use 5%) raised to a negative power (the year). Web in excel, navigate to:

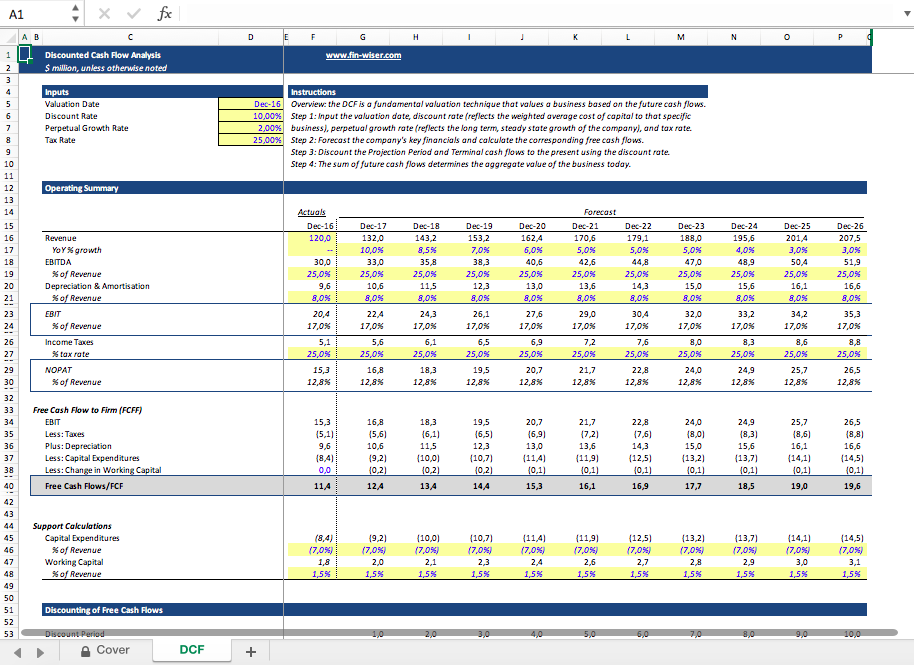

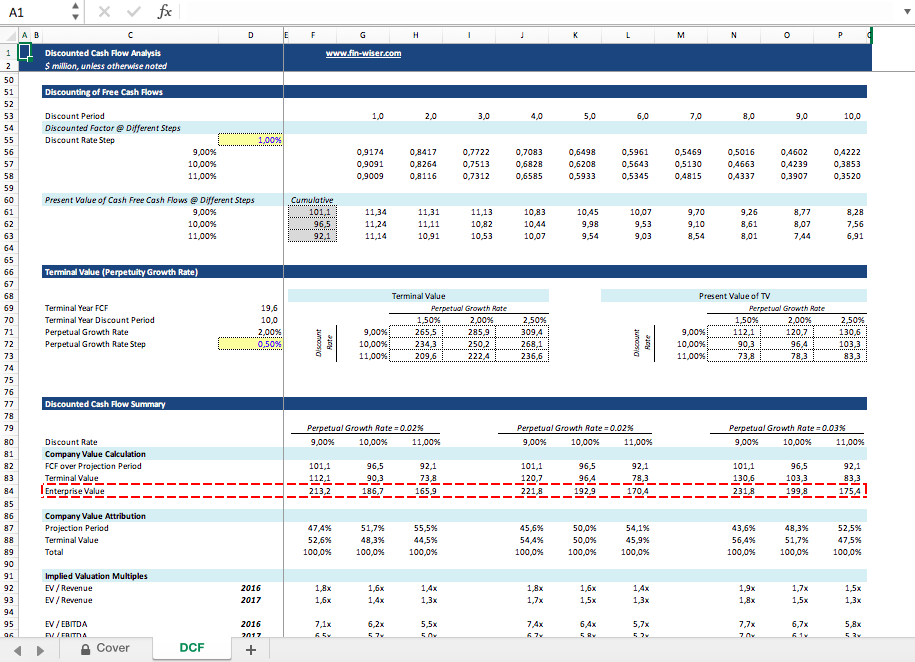

The cheat sheet below includes important discounted cash flow. We've gathered 10 of the best templates available online, and they're all free to download. Here’s a template for a discounted cash flow (dcf) analysis excel sheet: Here, cft = cash flow in period t (time) r = discount rate. Use the form below to download our sample dcf model template: =npv(discount rate, series of cash flows) (vynt) dcf excel template main parts of the financial model:

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web in excel, navigate to: (vynt) dcf excel template main parts of the financial model: Web if you're looking for discounted cash flow excel templates, look no further! Use the form below to download our sample dcf model template: Click to see full template. Download this template for free. This template allows you to build.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Cfn is the last year in the forecast.) r = the discount rate. Discounted cash flow excel sheet. Start free trial to access template. Discounted cash flow analysis template; Here’s a template for a discounted cash flow (dcf) analysis excel sheet: Discounted cash flow cheat sheet. The macabacus tab > new > sample models. Therefore,.

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

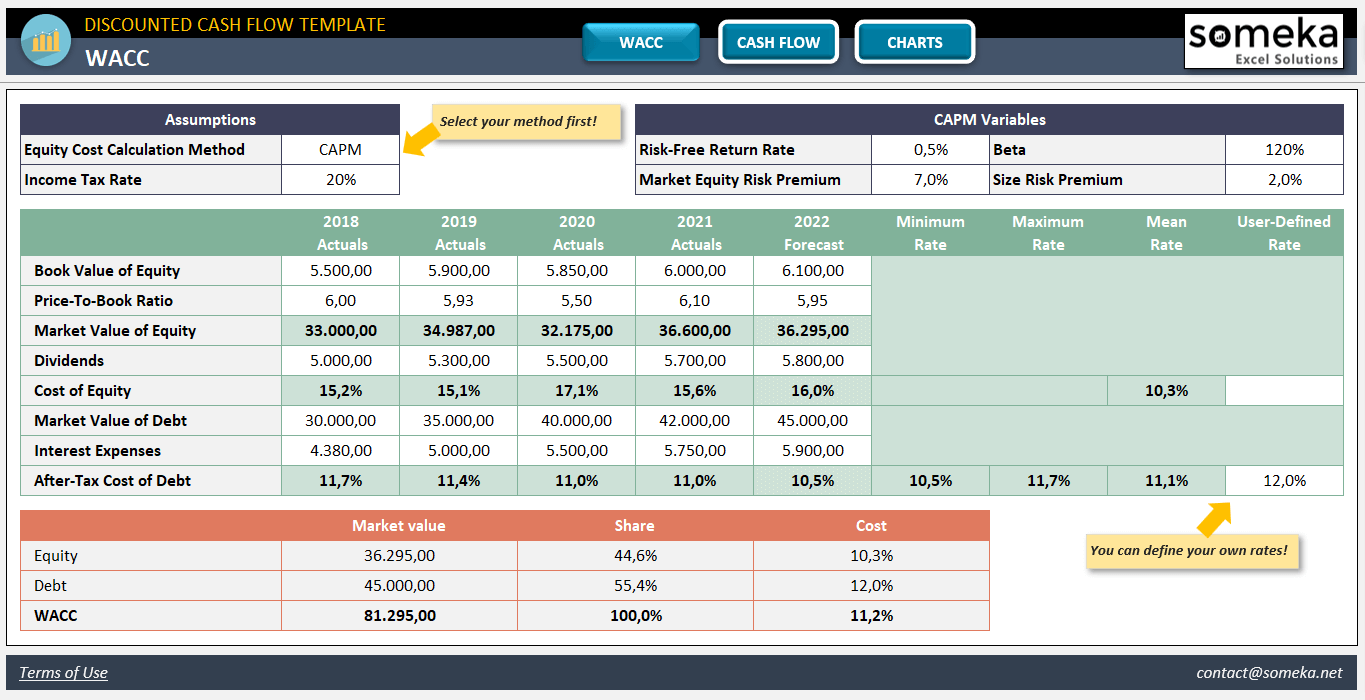

Discounted cash flow valuation template ; Web in excel, you can calculate this using the pv function (see below). Learn more → investment banking primer. Discounted cash flow analysis template; Web download discounted cash flow template excel | smartsheet. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn /.

Discounted Cash Flow Valuation in Excel Explained StepByStep Video

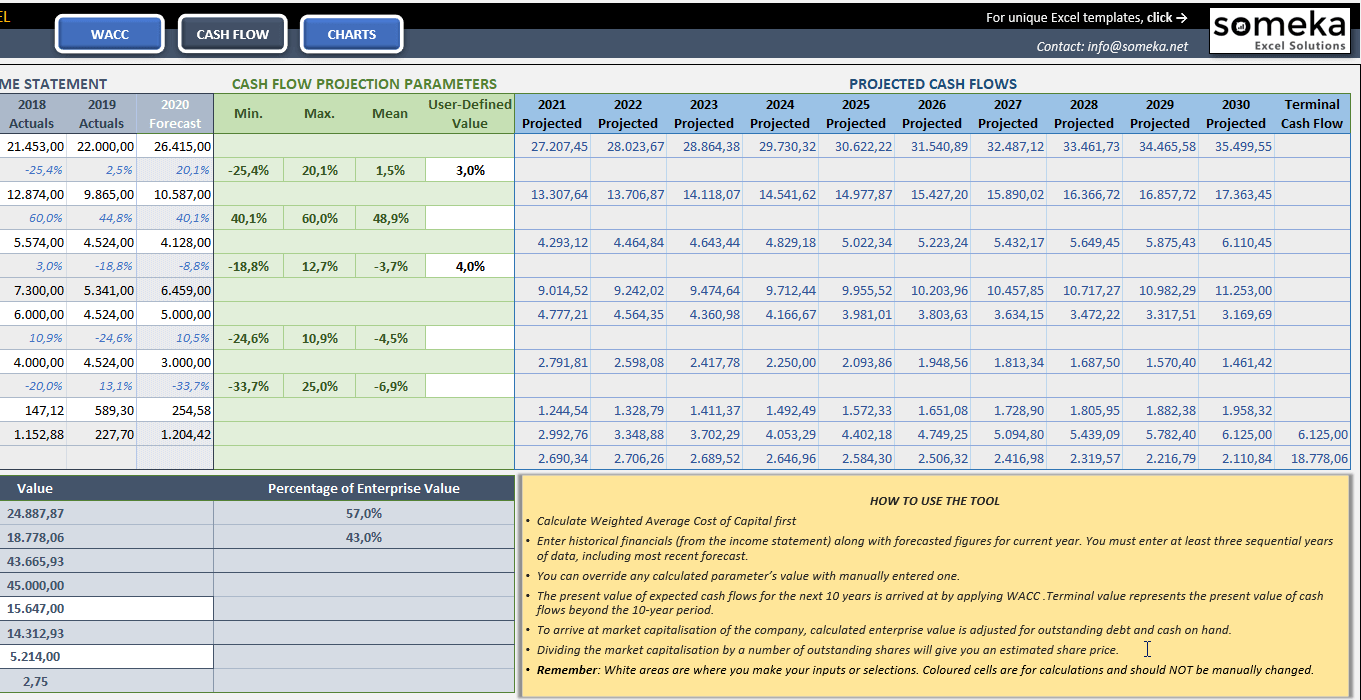

Web what is the function dcf in excel? We've gathered 10 of the best templates available online, and they're all free to download. Get support for this template. Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future..

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted cash flow excel sheet. (vynt) dcf excel template main parts of the financial model: Web discounted cash flow valuation excel » the spreadsheet page. I created a discount rate named range so that it’s easy to reference the percentage and to change it. Web in excel, navigate to: Web discounted cash flow model template;.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Where, cf = cash flow in year. Cfn is the last year in the forecast.) r = the discount rate. Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. Discounted cash flow cheat sheet. Use this template.

Free Discounted Cash Flow Templates Smartsheet

It includes an example to help you apply the calculations and is available for instant download. In this post, we'll discuss what discounted cash flow is and why it's important, then we'll showcase each of the 10 templates. Unlevered free cash flow calculation template; Net present value (npv) the discounted cash flow ( dcf) is.

Discounted Cash Flow Excel Template DCF Valuation Template

Get support for this template. Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. Web the formula states this: Web what is the function dcf in excel? Export this template to excel with just one click. Start by creating a table with the following columns: Dcf =.

discounted cash flow excel template —

Web download discounted cash flow template excel | smartsheet. Export this template to excel with just one click. The only thing left here is to calculate the total of all these. Learn more → investment banking primer. Start by creating a table with the following columns: Use the form below to download our sample dcf.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Download this template for free. Start free trial to access template. Nonprofit cash flow projection template. Therefore, all future cash flows must be taken into consideration. Web basic discounted cash flow formula: Get support for this template. And here are the relevant files and links: A discounted cash flow (dcf) analysis is one of the.

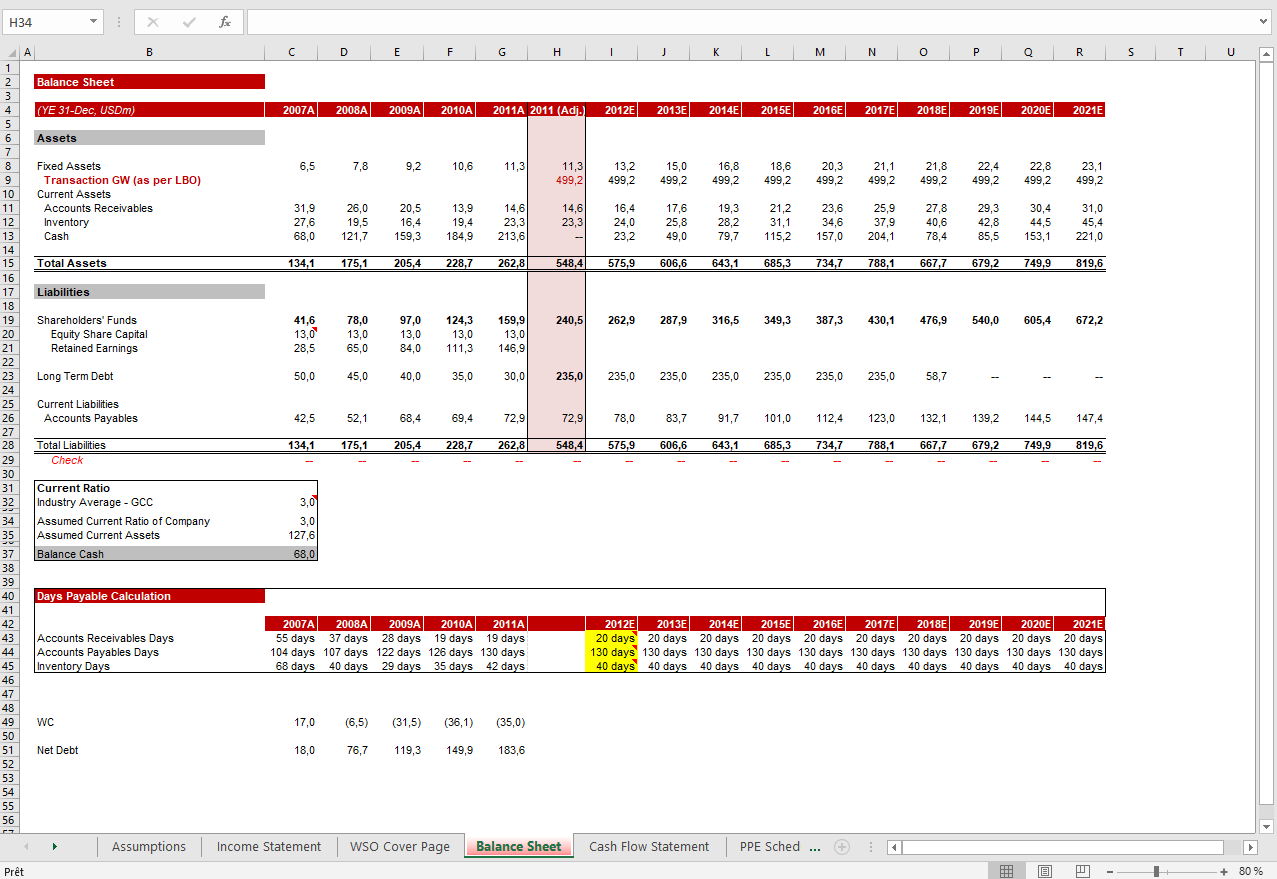

Discounted Cash Flow Template Excel Discounted cash flow (dcf) calculates the value of a company based on future cash flows; Nonprofit cash flow projection template. However, if cash flows are different each year, you will have to discount each cash flow separately: Sample discounted cash flow excel template; Cfn is the last year in the forecast.) r = the discount rate.

This Guide Will Teach You How To Get And Use A Free Dcf Template In Excel.

A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Web in excel, you can calculate this using the pv function (see below). Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. There are sections for cash receipts, contributions and support, government contracts, other revenue sources, and.

A Fully Customizable Excel Model To Match Your Needs, And Use As A Starting Point Or As A Full Dcf Tool For Valuation.

Start by creating a table with the following columns: Unlevered free cash flow calculation template; Web budget & accounting. Download this template for free.

Enter Your Name And Email In The Form Below And Download The Free Template Now!

The cheat sheet below includes important discounted cash flow. Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. Web to do that, i’ll use a formula that takes the cash flow value, multiples it by the discount rate (i’ll use 5%) raised to a negative power (the year). Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n.

=Npv(Discount Rate, Series Of Cash Flows)

The only thing left here is to calculate the total of all these. Start your dcf analysis today! This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. T = period of time (1,2,3,……,n) discounted cash flow (dcf) vs.