Depreciation Schedule Excel Template

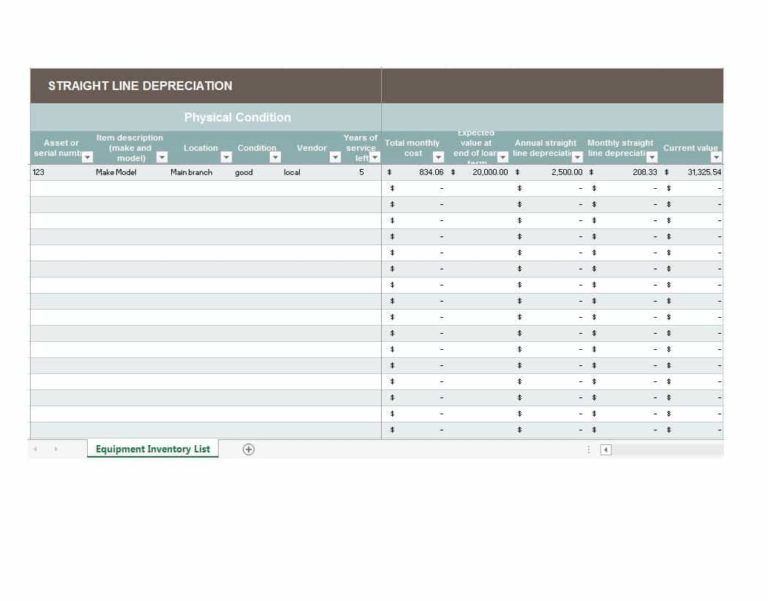

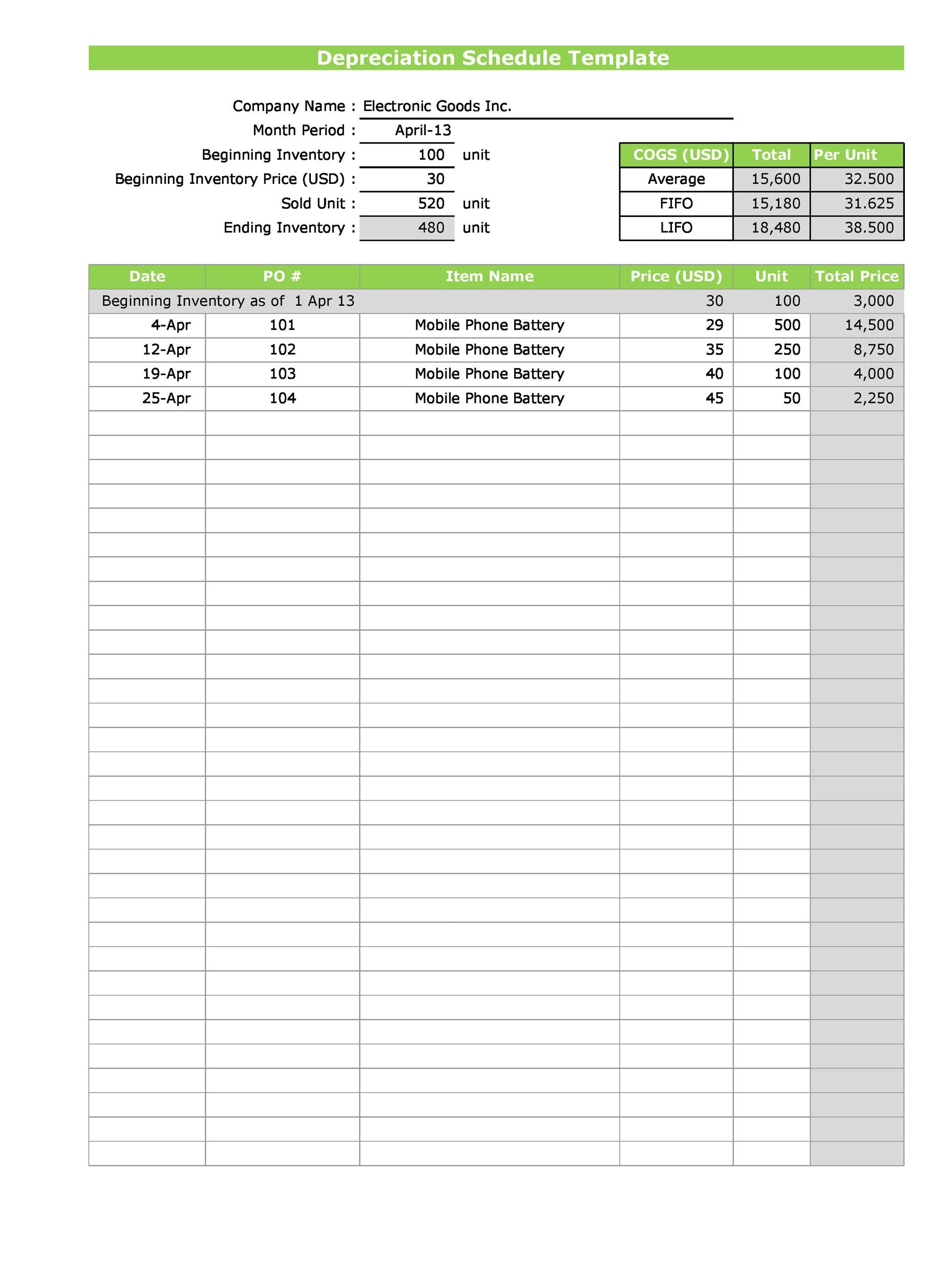

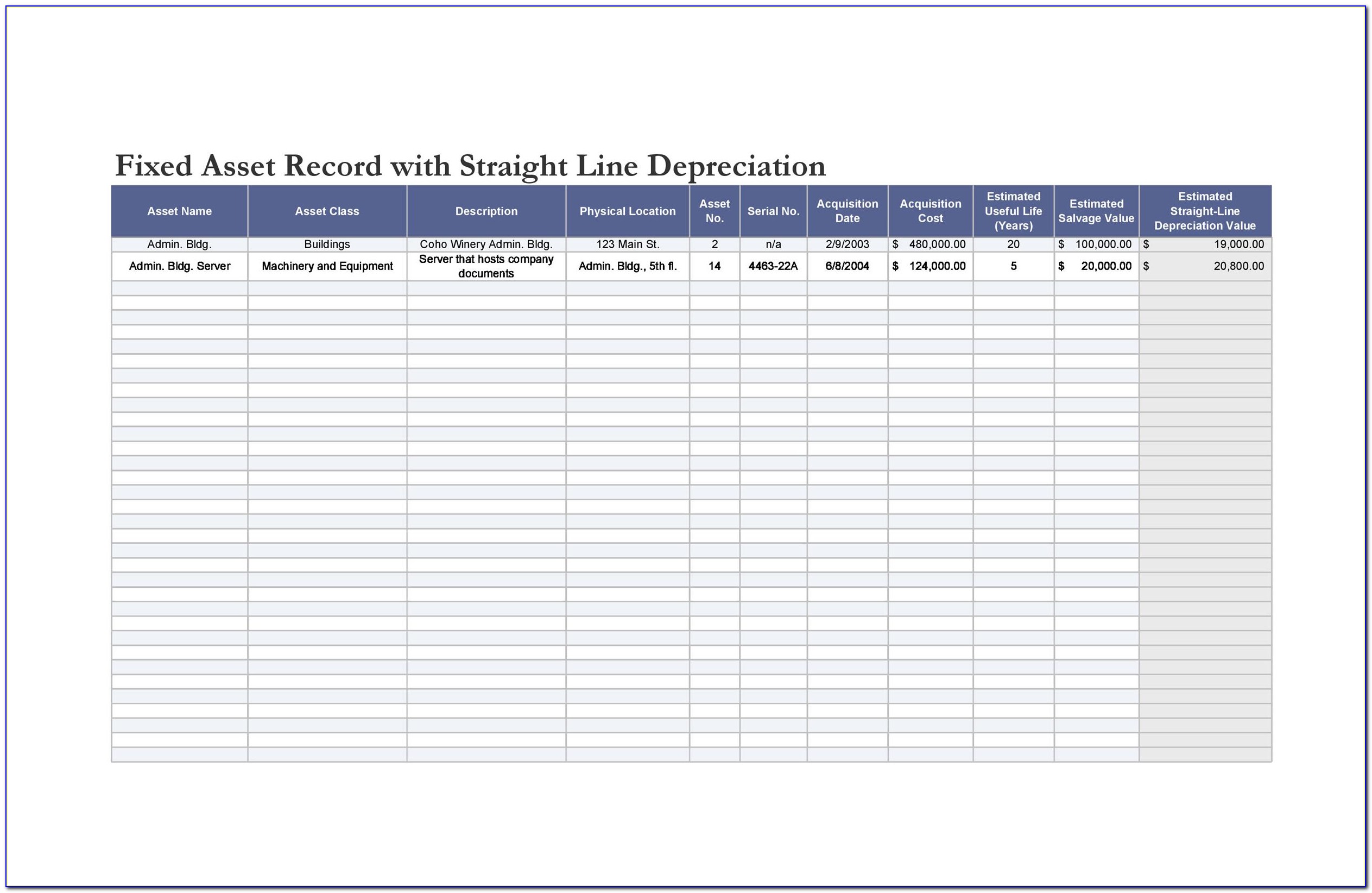

Depreciation Schedule Excel Template - The schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. Irs) depreciation formula the depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. Enter your name and email in the form below and download the free template. You can find endless template options on the microsoft website. Here, we used excel 365.

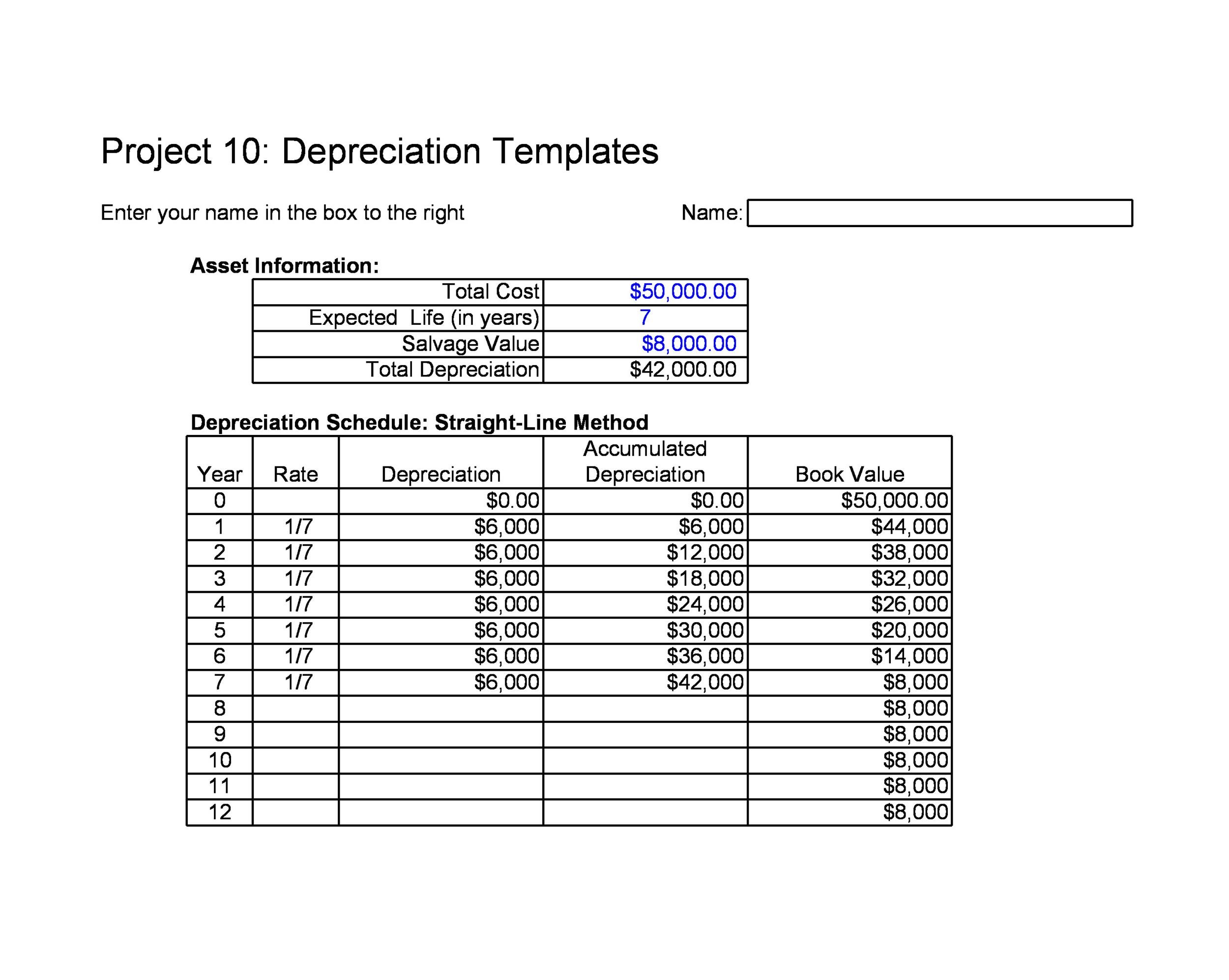

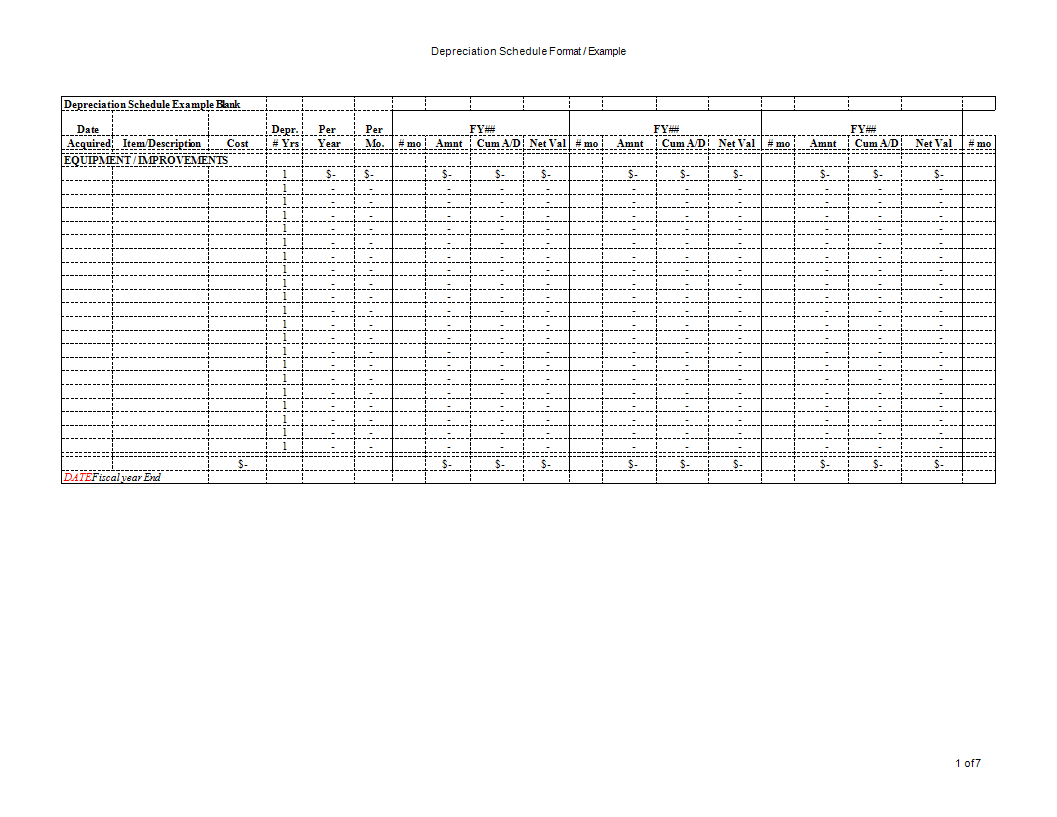

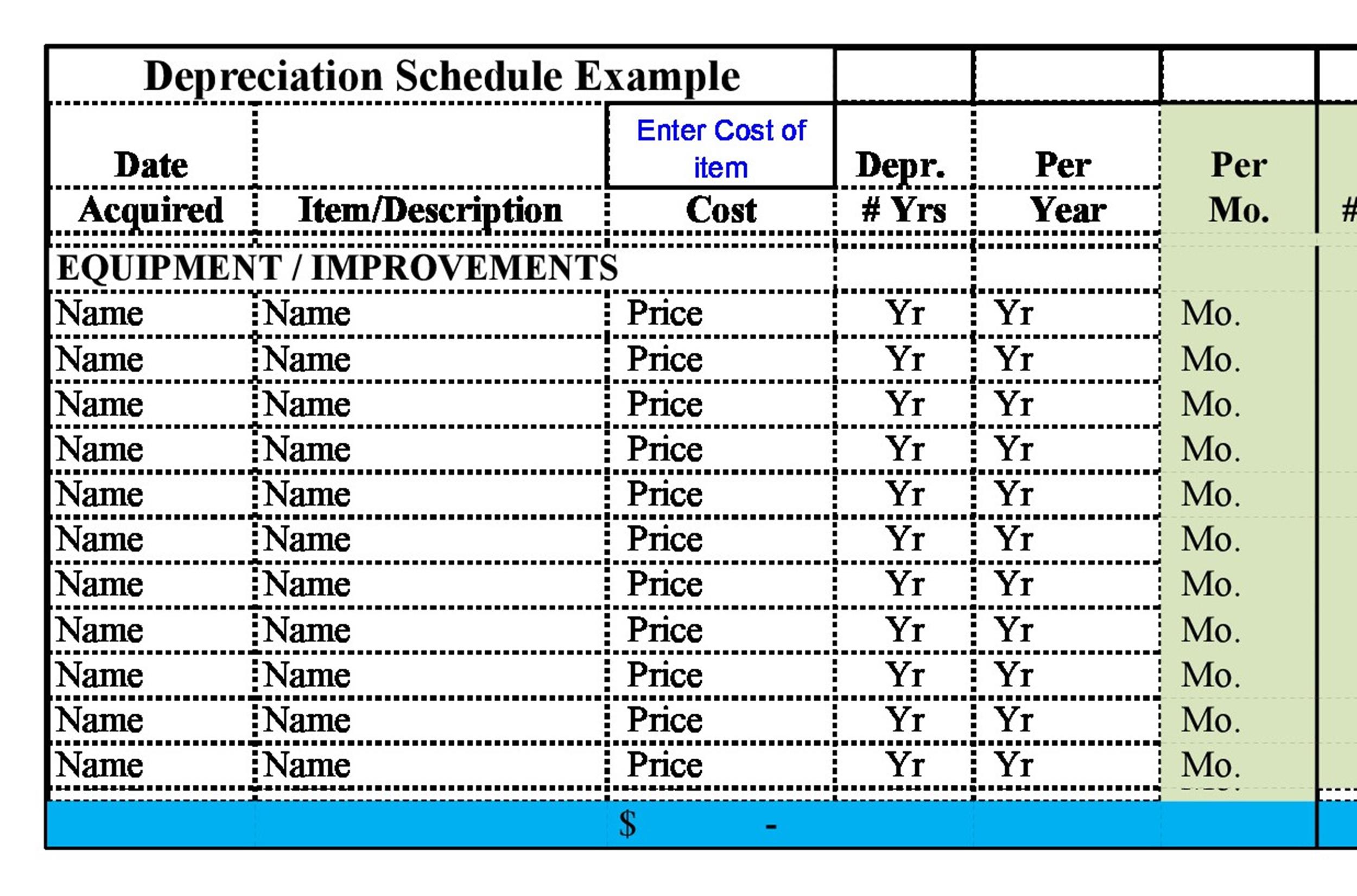

Below is a preview of the depreciation methods template: Web create from scratch show all follow a schedule to stay on top of your life design custom schedule templates to help you plan out your year and manage projects for your business. (years left of useful life) ÷. This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. Irs) depreciation formula the depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. Web you should make your depreciation schedule in a spreadsheet. Web depreciation schedule example blank equipment your organization's board should approve a capitalization threshold policy that covers how it approves capital purchases (i.e., equipment or furniture with a useful life of more than one year) and establish a cost above which a purchase should be capitalized rather than expensed.

13+ Depreciation Schedule Templates Free Word Excel Templates

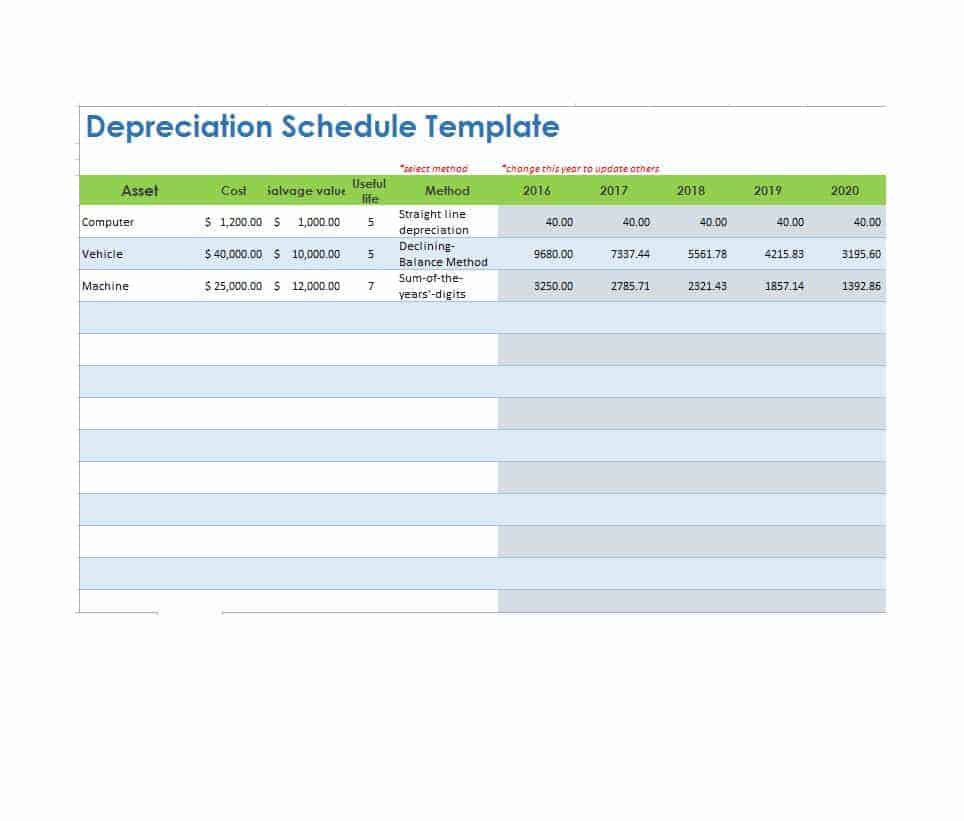

Web depreciation schedule template (c) 2009 vertex42 llc. The schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. Asset price year salvage life method asset name sl syod. Web the depreciation schedule records the depreciation expense on the.

Straight Line Depreciation Schedule Excel Template For Your Needs

This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. The schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. One can use these free templates for both.

Depreciation Excel Template Database

Not applicable to macrs for tax reporting. Here is a preview of the template: Irs) depreciation formula the depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. In the following dataset, you can see the assets, purchase date, actual cost, salvage value, and depreciations rate columns..

Depreciation Schedule Template Excel Free Printable Templates

Not applicable to macrs for tax reporting. Web excel offers five different depreciation functions. This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. Use excel to set schedules by the month, day, and even down to the hour. Web these templates for depreciation schedule.

Depreciation Schedule Template Excel Free Printable Templates

(years left of useful life) ÷. I made my own because, as tabitha brown says, that’s my business. The formula to calculate the depreciation expense in a given period is as follows. Web you should make your depreciation schedule in a spreadsheet. Download the free template enter your name and email in the form below.

Fixed Asset Monthly Depreciation Schedule Excel Template

Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose. Irs) depreciation formula the depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. Methods schedule factors methods noswitch valuevx 42.31 depreciation schedule © 2009 vertex42.

Depreciation schedule Excel format Templates at

Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose. Here, we used excel 365. The schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. I made.

Schedule Of Real Estate Owned Excel Sample Excel Templates

Web a depreciation schedule helps to calculate the differences. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web 8 steps to calculate monthly depreciation schedule in excel. Methods schedule factors methods noswitch valuevx 42.31 depreciation schedule © 2009 vertex42 llc for financial reporting only. Below you.

Straight Line Depreciation Schedule Excel Template For Your Needs

Web depreciation schedule example blank equipment your organization's board should approve a capitalization threshold policy that covers how it approves capital purchases (i.e., equipment or furniture with a useful life of more than one year) and establish a cost above which a purchase should be capitalized rather than expensed. Below you can find the results.

13+ Depreciation Schedule Templates Free Word Excel Templates

Web these templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic and easier. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: One can use.

Depreciation Schedule Excel Template (years left of useful life) ÷. Leave fields for you to add in details of what task you want to complete during the time. This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. Download the free template enter your name and email in the form below and download the free template now! Web create from scratch show all follow a schedule to stay on top of your life design custom schedule templates to help you plan out your year and manage projects for your business.

Web This Depreciation Methods Template Will Show You The Calculation Of Depreciation Expenses Using Four Types Of Commonly Used Depreciation Methods.

Web excel offers five different depreciation functions. Below you can find the results of all five functions. It allows you to reduce your taxable income, paying less in taxes and sometimes paying no tax at all. Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose.

I Made My Own Because, As Tabitha Brown Says, That’s My Business.

Web you should make your depreciation schedule in a spreadsheet. Here is a preview of the template: Download the free template enter your name and email in the form below and download the free template now! Web double declining balance depreciation template.

Use Excel To Set Schedules By The Month, Day, And Even Down To The Hour.

In the following dataset, you can see the assets, purchase date, actual cost, salvage value, and depreciations rate columns. Web depreciation schedule template (c) 2009 vertex42 llc. Web depreciation schedule example blank equipment your organization's board should approve a capitalization threshold policy that covers how it approves capital purchases (i.e., equipment or furniture with a useful life of more than one year) and establish a cost above which a purchase should be capitalized rather than expensed. Here, we used excel 365.

We Consider An Asset With An Initial Cost Of $10,000, A Salvage Value (Residual Value) Of $1000 And A Useful Life Of 10 Periods (Years).

The formula to calculate the depreciation expense in a given period is as follows. Download the free template enter your name and email in the form below and download the free template now! Leave fields for you to add in details of what task you want to complete during the time. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: