Asc 842 Lease Accounting Template

Asc 842 Lease Accounting Template - Click the link to download a template for asc 842. Web under the new lease accounting standard asc 842, the lease is either an operating lease or a finance lease. Unlike operating leases under asc 842, accounting for a finance lease under asc 842 is not too dissimilar to the accounting for a capital lease under asc 840. A streamlined & simplified lease classification process for lessees. Web 20 lease accounting 842 jobs available in remote on indeed.com.

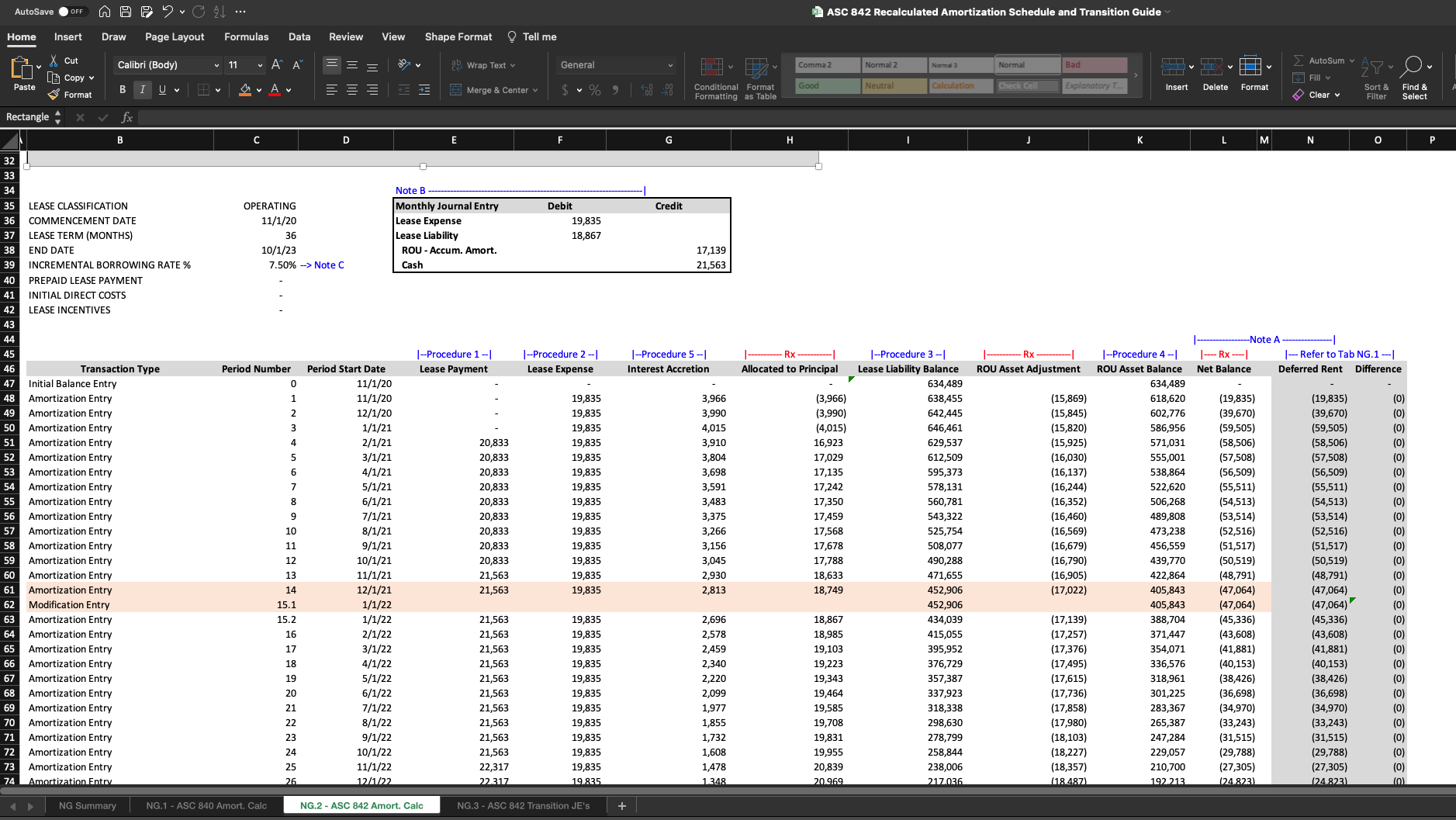

Web asc 842 lease accounting memo. Please fill out form fields. It specifically does not apply to the following nondepreciable assets accounted for under other fasb asc topics: Our executive summary highlights key accounting changes and organizational impacts for lessees applying asc 842. A finance lease supersedes a capital lease under asc 840. Web under asc 842, operating leases and financial leases have different amortization calculations. Lessor accounting remains largely unchanged from asc 840 to 842.

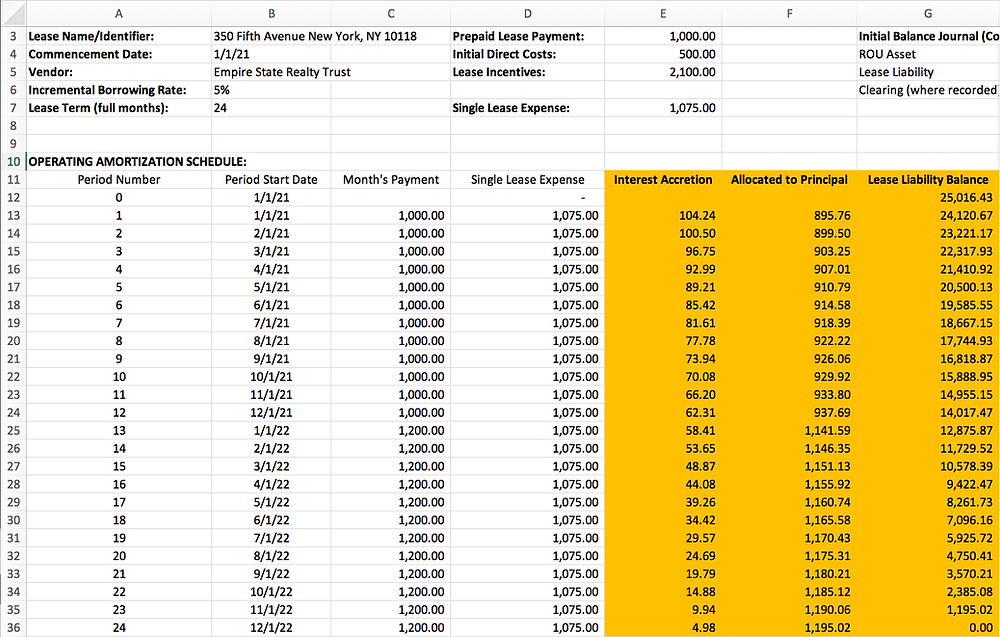

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; Lessor accounting under asc 842. Web lease accounting software. Web under the new lease accounting standard asc 842, the lease is either an operating lease or a finance lease..

Excel Solution

Web 14.1.1 embedded leases and scope of the leasing guidance (asc 842/ifrs 16) under both asc 842 and ifrs 16, even if not a lease in its entirety, an arrangement includes an embedded lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange.

Asc 842 Lease Accounting Excel Template

Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; A finance lease supersedes a capital lease under asc 840. While you’ve heard us proclaim from the mountaintop about the significant changes to lease accounting standards brought about by.

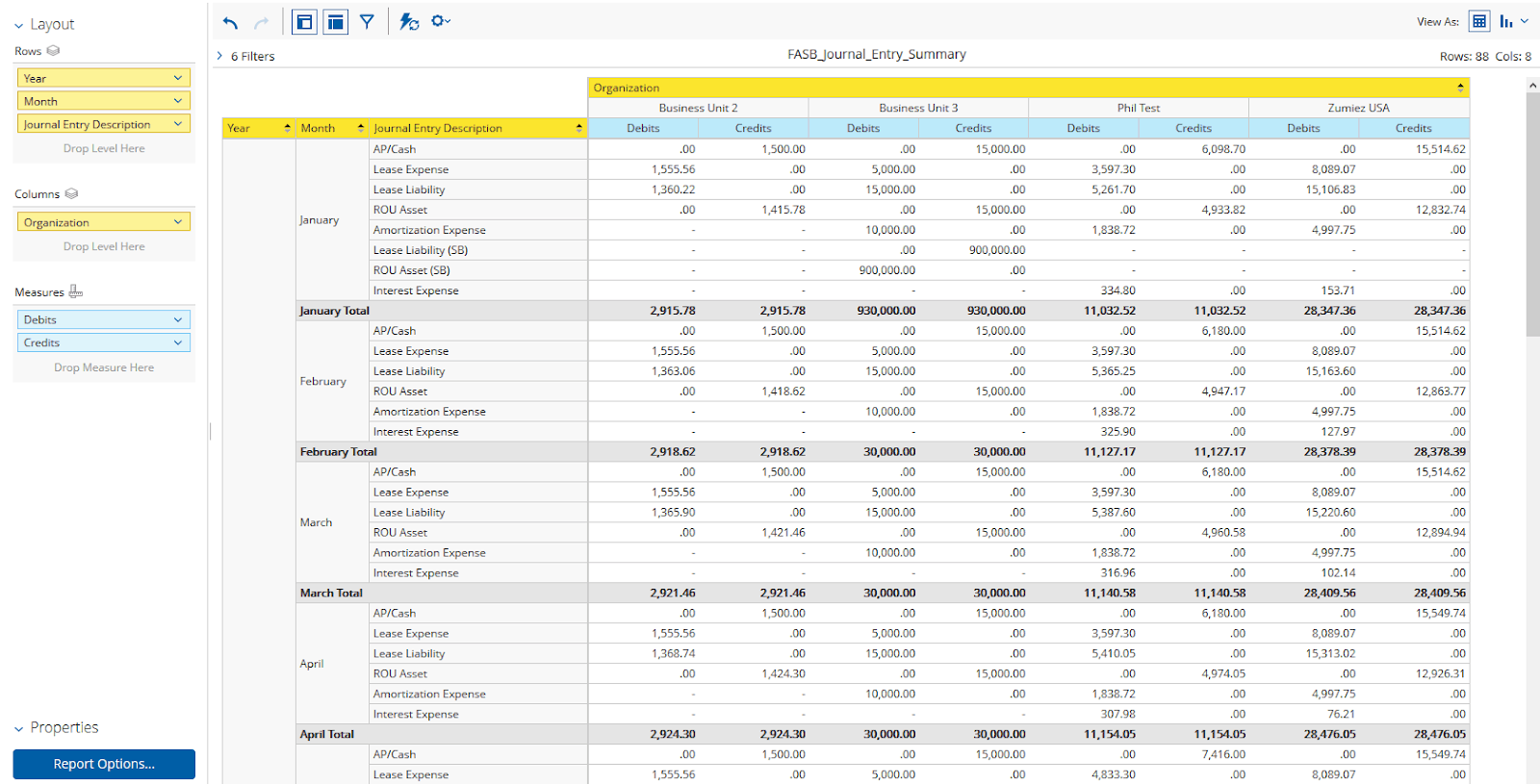

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

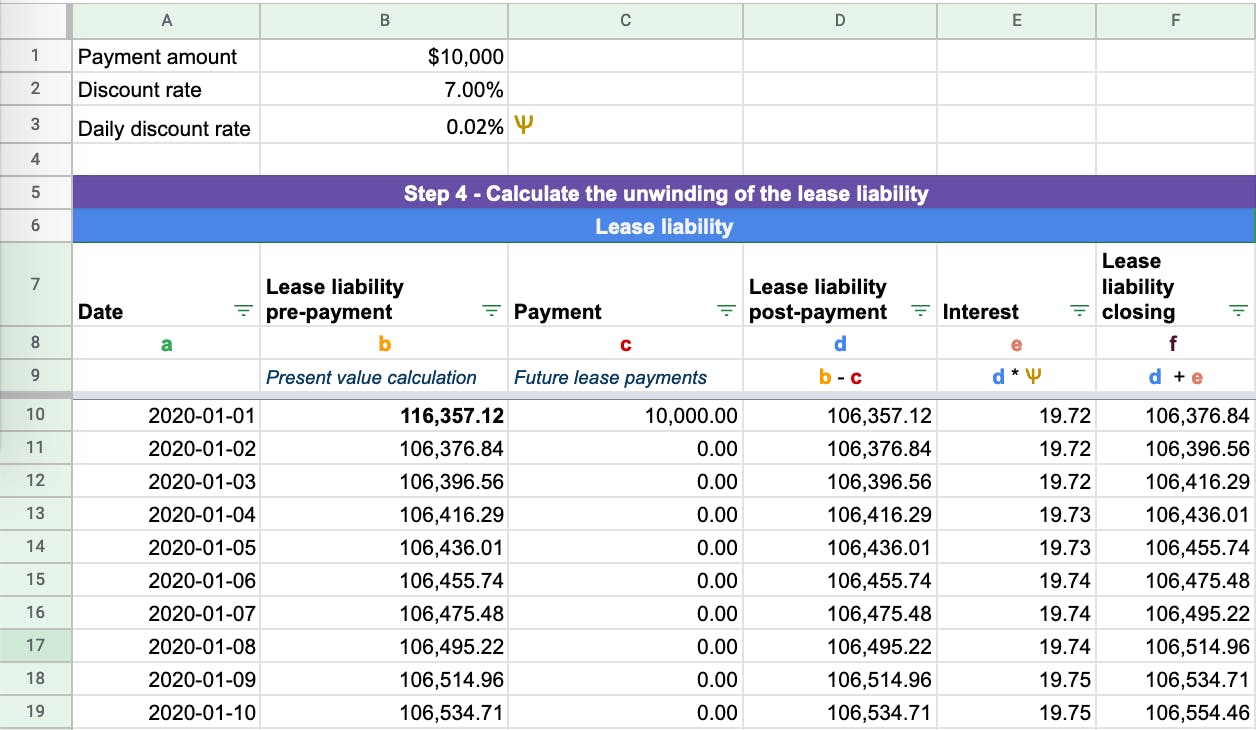

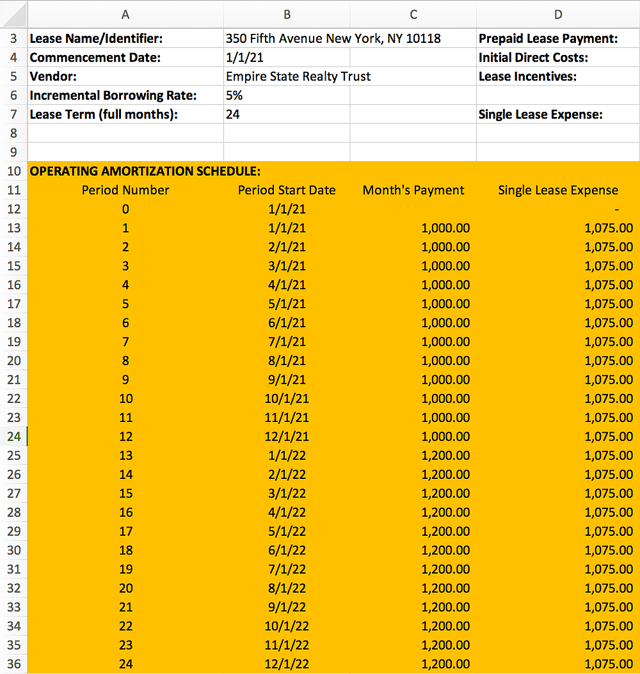

Web on february 25, 2016, the fasb issued accounting standards update no. The value of the initial right of use asset is the 'present value'. Those columns will be called date, lease liability, interest, payment, closing balance. Web lease accounting software. With our excel template, you will be guided on how to calculate your lease.

Sensational Asc 842 Excel Template Dashboard Download Free

Please fill out form fields. Web akin to asc 840, the new lease accounting standard asc 842 prescribes the lessee to determine the lease classification. Click the link to download a template for asc 842. Web on february 25, 2016, the fasb issued accounting standards update no. A finance lease supersedes a capital lease under.

Asc 842 Lease Accounting Excel Template

(example continued below) easy testing. Web automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; Web larson lease accounting template asc 842. Web asc 842 lease classification test. The value of the initial right of use asset is the 'present value'. Determine the lease term under asc 840. Please fill.

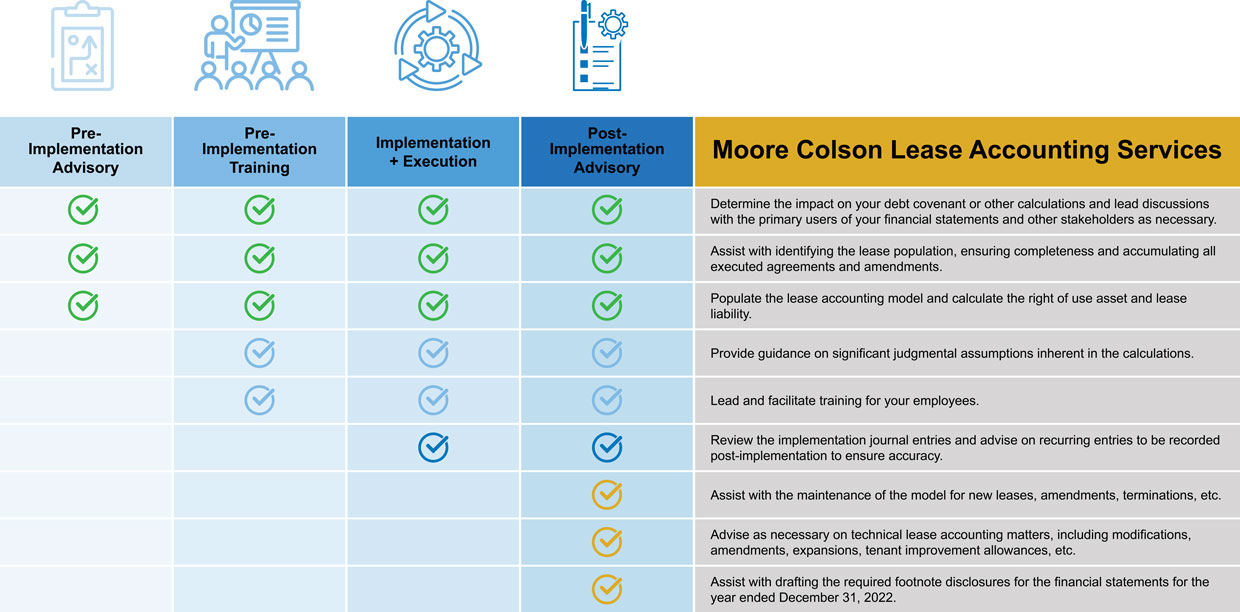

Lease Accounting Standard ASC 842 Implementation Atlanta CPA

Web the fasb’s new standard on leases, asc 842, is already effective for public companies and is replacing today’s leases guidance for other companies in 2021. Initial right of use asset and lease liability. Please fill out form fields. Web automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; With.

Asc 842 Lease Template Excel

The basic postings for lease contracts based on asc 842 consist of four steps: While you’ve heard us proclaim from the mountaintop about the significant changes to lease accounting standards brought about by asc 842, it’s one thing to discuss those. A streamlined & simplified lease classification process for lessees. Calculate the operating lease liability..

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Apply to senior accountant, accounting manager, director of accounting and more! Web asc 842 lease accounting memo. Unlike operating leases under asc 842, accounting for a finance lease under asc 842 is not too dissimilar to the accounting for a capital lease under asc 840. However, under asc 842, it's no longer the classification between.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

A finance lease supersedes a capital lease under asc 840. If you are recording an operating lease, the lessee is responsible for making periodic payments in exchange for using the. Web larson lease accounting template asc 842. Web asc 842 lease classification test. Load this example into ezlease from our bulk import template. This asc.

Asc 842 Lease Accounting Template Load this example into ezlease from our bulk import template. A finance lease supersedes a capital lease under asc 840. Web asc 842 lease accounting memo. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Web larson lease accounting template asc 842.

Web The Asc 842 Lease Classification Template For Lessees Is Now Available For Download.

Web 20 lease accounting 842 jobs available in remote on indeed.com. Lessees in the scope of asc 842. Lessor accounting under asc 842. This guide discusses lessee and lessor accounting under asc 842.

Web We Unpack Hot Topics In Lease Accounting Under Asc 842 And Considerations For Entities That Haven’t Yet Adopted The New Standard.

While this memo addresses many items in asc 842, this template may not address a topic specific to your company. Unlike operating leases under asc 842, accounting for a finance lease under asc 842 is not too dissimilar to the accounting for a capital lease under asc 840. The value of the initial right of use asset is the 'present value'. With these inputs, we'll calculate the monthly lease liability amortization schedule.

Apply To Senior Accountant, Accounting Manager, Director Of Accounting And More!

Click the link to download a template for asc 842. Web tips, insights, and a handy template from embark’s asc 842 experts to help lessees identify and properly account for those pesky embedded leases in contracts. If you are recording an operating lease, the lessee is responsible for making periodic payments in exchange for using the. Help implement asc 842 lease accounting standard and then maintain accounting records for all ara leases.

This Asc 842 Accounting Memo Template For Lessees Should Be Used As A Guide When Your Accounting Team Is Assessing The Impact Of Asc 842 To Their Business.

Our executive summary highlights key accounting changes and organizational impacts for lessees applying asc 842. It specifically does not apply to the following nondepreciable assets accounted for under other fasb asc topics: Obtaining the excel file will also allow you to use it as a template for future lease calculations. Web asc 842 lease accounting memo.